Yearly Range for the Year 2021

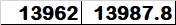

This is my Third Year when I am trying my Math-0-Magic study to find some Higher Level Support and resistance. NIFTY CALCULATOR Up Side Down Side 14,440.24 13,523.26 15,076.39 12,887.11 15,901.67 12,061.83 16,514.90 11,442.86 17,305.80 10,657.70 CMP SPOT 13,981.75 DATE 31st Dec, 2020 Year Range 2021 As per this Levels which are coming out in the above image number box if nifty fails to cross 14440 level, it will try to visit its its support level at 13523.26. Till 13523.26 is saved by bulls it would not be difficult for bulls to attain 15076 level. In Higher Time Frame there is no Weakness. However we must not forget Newton's Law of Gravitation. Hope to this Price levels as support and resistance for nifty. Keep Learning # Keep Earning # Enjoy Life