On the Note of Negative Close of 1st Weekly Expiry of the Year 2021 Nifty closed at 14137.35 (Spot) and Future at 14203.90.

As today ( 07-01-2021) was expiry non can have 100% success in anticipating market move as Makers are cunning that We ( People like me small trader) Miss their move easily. Though Opening and move till 2:15 was as per expected but Spot dashed huge but FUT levels hold high with Falling VIX

Now question is why such thing happen?

The open was for disturbing short position of weak traders and down slide was PE sold players had to be sacrificed.

Postmortem is easy but real time is bit difficult if you dont know the resistance and support.

However coming to data in Weekly OC Good amount of Put Writers are there in system, but Hidden PCR is at higher level which is creating a clog in upmoFve or range breakout of nifty.

IV is in favour of bulls

Again 15000 level is hitting my attention and again OC is suggesting 14440 and 13830 level as per OC as available today.

Only 43 times excess put writing over Call writing in Monthly OC

BIG BOYS are in Buying mood and as usual they have kept their Hedge position open but this poor Clients hidden Bullish (PUT sellers ) would not be allowed to get the juice and nifty is likely to open in soft down note.

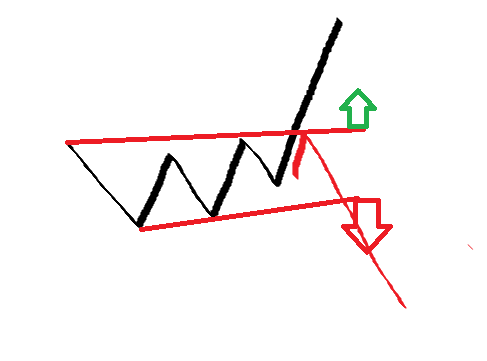

No wrong in drawing Free hand chart art_ food for mind _ Refresh your mood.

And coming to immediate Support and resistance following are the levels :

I have not Noticed any divergence in Technical Chart pattern

Having two successive Red Candle does not mean Higher TF has given Sell Signal now,

No comments:

Post a Comment